SINGAPORE, 23 June 2022: Booking.com has launched its inaugural APAC Travel Confidence Index, which provides a snapshot of how confident consumers feel about exploring the world again and whether they would welcome inbound travel.

The commissioned research polled 11,000 travellers from 11 countries and territories¹ across Asia and Oceania between April and May 2022, combining this with the company’s proprietary data and insights as a digital travel leader over the past 25 years.

The Travel Confidence Index explores the overall comfort levels, motivators and concerns of consumers across the Asia Pacific and how this varies across the region. At the same time, while there is a strong overall desire to travel more sustainably, the research also sheds light on the more pragmatic considerations of travellers – such as cost and variety of sustainable stays – which impact whether sustainable intent ultimately translates into action.

As Asia starts to emerge from several years of strict border closures and lockdowns, the diversity in terms of consumer travel sentiment and confidence across the Asia Pacific has certainly become more pronounced, with key findings highlighted below.

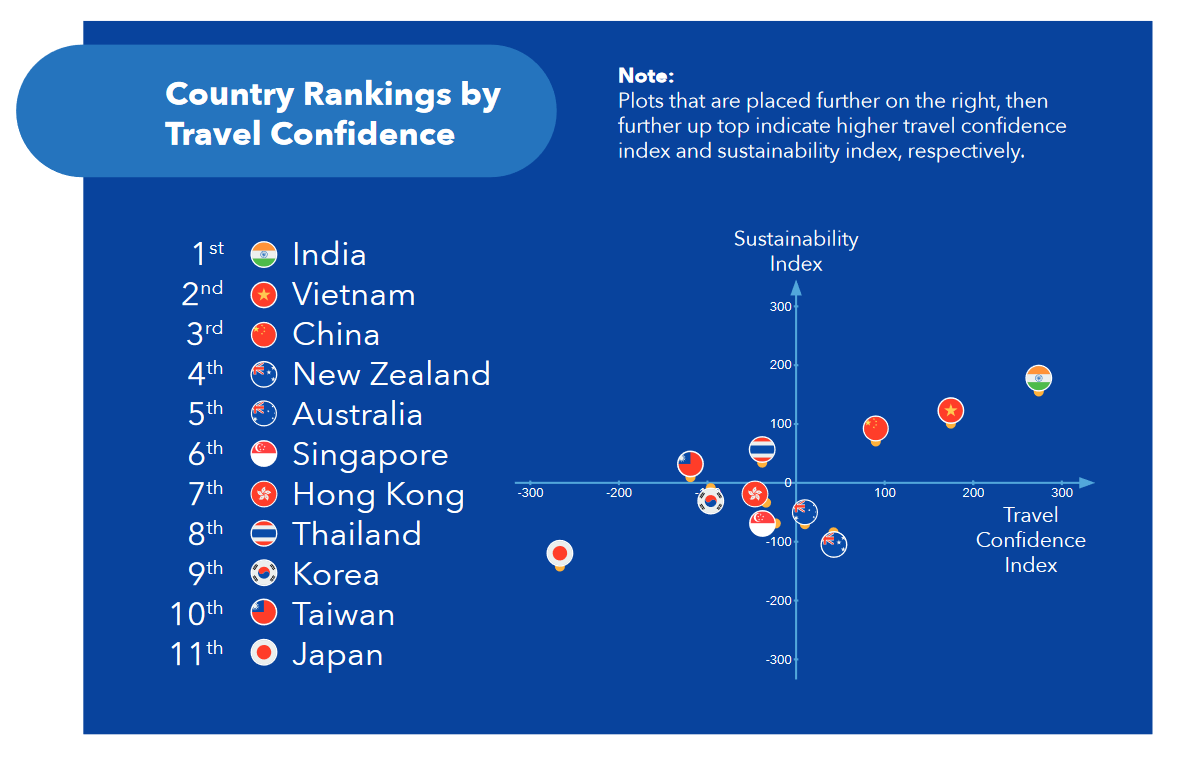

Across the 11 markets polled, India emerged most confident, with 86% of Indian travellers stating they intend to travel in the next 12 months, followed closely by Vietnam and China. While North Asian markets of Korea, Taiwan and Japan ranked lower on the index in terms of overall confidence, travel intent among respondents remained relatively high (above 60%).

The research indicates that Indian, Vietnamese and Chinese respondents were most willing to put up with and/or overlook key travel deterrents in order to travel – which included enduring disruptions and travel costs, as well as confidence in their home countries/territories in receiving inbound travellers. Conversely, a majority of Japanese respondents (75%) expressed uncertainty about border reopenings, as well as their country’s preparedness to safely receive international travellers (82%). This uncertainty is reflective of the continued turbulence the COVID-19 pandemic has wrought on the travel industry and ultimately in the way consumers perceive travel.

Singapore ranked 6th on the Travel Confidence Index despite having some of the most eased border restrictions in comparison to many markets across the region. Key factors that impacted Singapore’s standing in the index included general aversion towards any disruptions to their travel (65%) alongside that of sharing personal information for public health and safety (57%) and personalisation (45%) – a key element in most countries’ Covid-19 management strategies.

When looking at how far Singaporeans would travel, 69% of respondents stated that they planned to take trips (up to 8 hours) to popular holiday destinations closer to homes, such as Thailand and Indonesia.

Top travel motivators

The desire to travel remains strong amongst Asia Pacific travellers overall, with ease of planning and booking travel, as well as cost, being the top two considerations. Both ranked consistently high across all markets, even as restrictions continue to ease around the region.

The desire to “just get away” (46%) also emerged as the top motivator to travel for APAC consumers after two years of lockdowns and a rapidly evolving travel landscape, followed closely by a “getaway to recharge mentally” for 36% of respondents. In fact, for Thailand, such retreats were the prime motivator for an overwhelming 76% of respondents, a percentage far higher than any other market.

Across the region, only 13% indicated that work was a reason for them to book a trip, despite many employees have returned to the office across the Asia Pacific, which could bode a slower revitalisation in corporate vs leisure travel. In Australia, work was the least common reason for travel at 6%.

Top travel deterrents

Uncertainty due to the constantly evolving Covid-19 situation continues to plague travellers. When asked about their top concerns and what would prevent them from booking a trip, ‘travel cost’ was listed as the number one deterrent by 38% of all respondents. This was followed by the ‘fear of having to undergo quarantine’ (37%) and the ‘possibility of getting stuck because of frequently changing border regulations’ (37%).

Top concerns for several destinations varied quite significantly. In Singapore, China and Hong Kong, the top concern was the possibility of getting stuck at the destination because of new border regulations (61%, 53%, 55%, respectively), while in Japan, the top concern of 47% of respondents was falling ill whilst travelling.

Interestingly, when asked whether travellers accepted disruptions as part and parcel of travel now, nearly half of Japanese (47%) and Korean (32%) respondents said no – the only two markets to do so.

Sustainable travel remains top of mind

According to Booking.com’s 2022 Sustainable Travel Report, 81% of global travellers affirm that sustainable travel is important to them, with 50% stating that recent news about climate change has influenced them to make more sustainable travel choices.

In APAC, India once again topped the index in terms of intent to travel sustainably, with 93% of respondents agreeing on the importance of making sustainable travel decisions. On the other hand, for travellers from markets such as Australia, New Zealand and Japan, cost and a wide variety of sustainable stay options are core considerations when making sustainable travel decisions.