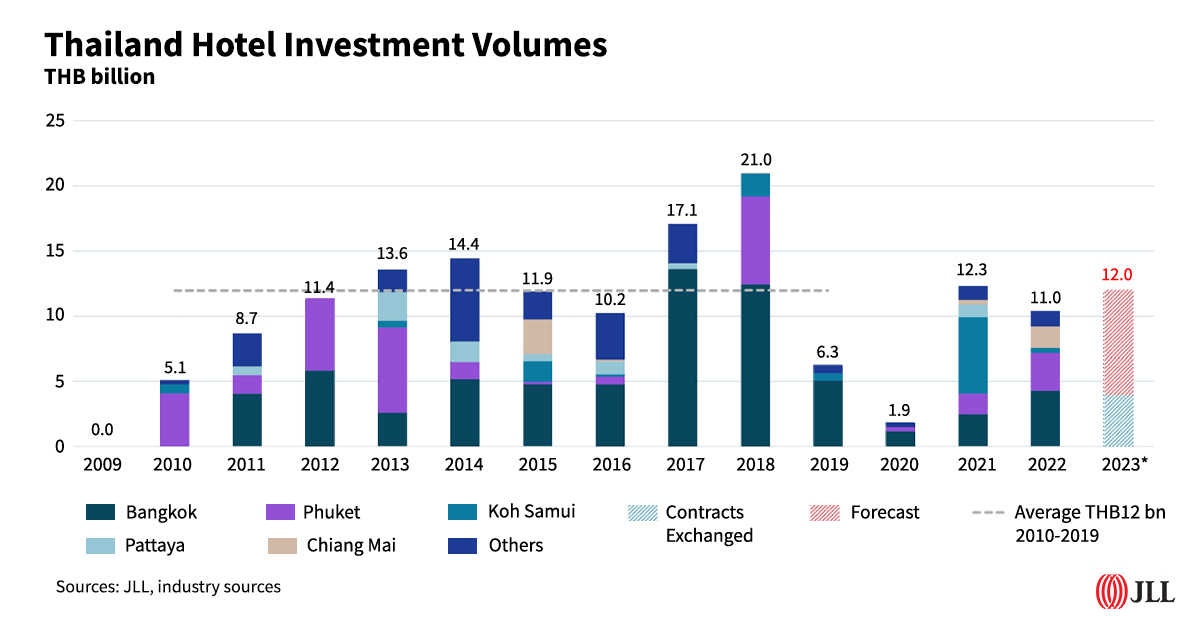

BANGKOK, 14 February 2023: Data from property consulting firm JLL reveals that Thailand saw 14 investment-grade hotel transactions totalling THB11 billion in 2022, dropping from THB12.3 billion in 2021 due largely to a slippage of some transactions that did not close before the end of 2022.

However, with continued investor interest and availability of investment-grade assets, JLL expects hotel investment activity in Thailand to grow to THB12 billion this year.

JLL Hotels & Hospitality Group executive vice president of investment sales, Asia Pacific Chakkrit Chakrabandhu Na Ayudhya said: “The total hotel investment volume in 2022 could have made a new high post-Covid if several transactions with exchanged contracts had not seen a delay in completion. With a combined value of approximately THB4 billion, these deferred transactions have been rescheduled for completion in the first half of 2023.

“Despite a 10.6% decline, 2022 represents another strong year in terms of hotel investment activity post-Covid, with the total transaction volume seeing a nearly fivefold increase from just THB1.9 billion in 2020 when Thailand’s tourism market started feeling a severe impact of the pandemic,” he added.

The hotel transactions in 2022 spread across Bangkok, Phuket, Koh Samui, Koh Pha Ngan, Krabi, Hua Hin, and Chiang Mai, according to JLL. Bangkok, Phuket and Koh Samui remained the top three hotel investment destinations accounting for nearly 70% of the countrywide total transaction volume recorded last year. Bangkok led the pack, witnessing two notable hotels sold with a combined transaction value that accounted for nearly 40% of the total volume. These include Oakwood Studios Sukhumvit Bangkok and Grand Mercure Bangkok Windsor, which were sold to Singapore-based Worldwide Hotels Pte Ltd (WWH) and a leading Thai real estate group, Asset World Corporation (AWC), respectively. JLL represented the sellers on both transactions.

“While all the hotels sold in 2022 belonged to Thai corporations or families, 80% of the investment capital was from domestic investors. This marks a major shift from 2021 when foreign capital accounted for 60% of the total hotel investment volume in Thailand,” commented Chakkrit.

AWC was the most active buyer in Thailand’s hotel investment market last year, according to JLL. Apart from Grand Mercure Bangkok Windsor, the group also acquired Westin Siray Bay in Phuket for approximately THB2.5 billion and dusitD2 Chiang Mai. The latter exchanged contracts in 2021, but it was not until last year that the transaction was complete.

“Looking ahead, we expect 2023 to be a bullish year for hotel investment activities in Thailand. Continued investor interest and a strong pipeline of ongoing hotel investment deals are likely to push hotel investment volume this year to THB12 billion, the pre-COVID annual average volume witnessed between 2010 and 2019,” said Chakkrit.

Supporting Chakkrit’s forecast JLL Hotels & Hospitality Group senior vice president of advisory & asset management Rathawat Kuvijitrsuwan

noted: “There are factors that will drive investment activity in Thailand’s hotel market this year. Many owners have struggled to hold their hotel assets over the past three to four years. Whilst some of these owners are experiencing more challenges, including lenders’ less compromising credit terms and interest rate hikes, the clear path to full recovery of Thailand’s tourism, supported by the reopening of China, is giving them confidence that they are now in a better position to dispose of their hotels.

“On the demand side, we have continued to see strong interest from local and foreign investors in investment-grade hotels in Thailand. Findings from JLL’s Investors’ Sentiment Survey 2H2022 show that Thailand ranked the third most attractive hotel investment destination in the Asia Pacific, after Japan and Australia/New Zealand,” Rathawat concluded.

About JLL

JLL (NYSE: JLL) is a leading professional services firm specialising in real estate and investment management. JLL is a Fortune 500 company with annual revenue of USD19.4 billion, operations in over 80 countries and a global workforce of more than 102,000 as of 30 September 2022. For further information, visit jll.co.th.