SINGAPORE, 14 March 2023: With more than 166 million international trips booked by Chinese travellers in 2019, contributing over USD245 billion to global tourism, it is no wonder that the world has been watching and waiting for China to reopen its borders after nearly three years of Covid-19 closure.

Now that China is easing travel restrictions, Sabre has sifted through its shopping and booking data to examine the impact of the reopening through 9 February 2023 on tourism in China and globally.

Key findings following reopening announcements on 26 December, 8 January, and 20 January

• A significant spike in shopping queries and requests, particularly for the outbound tourism industry;

• Strong demand among Chinese travellers for trips despite high airfares, with fares peaking at more than two times in January and one and half times in February when compared to pre-pandemic prices;

• Demand is outstripping supply, with Chinese airlines leading capacity growth;

• New booking habits suggest long-term travel confidence.

A surge in search and booking requests

Sabre’s shopping insights revealed that interest in inbound and outbound China routes surged in the week of 26 December, when China first announced plans to drop quarantine for overseas visitors, and again when mainland China reopened sea and land crossings with Hong Kong on 8 January.

Weekly searches for China-related routes (including the Special Administrative Regions of Hong Kong and Macau) have been increasing steadily after the announcements, and average weekly searches in the first five weeks of 2023 through to 5 February 2023 have been 78% higher compared to the average weekly searches in Q4 2022.

Strong outbound bookings

The reopening of China is already proving to be a key win for tourism recovery and potentially providing economic growth within the Asia Pacific region. Outbound travel has generally rebounded faster than inbound travel to the region. Sabre data shows outbound bookings making up 43.5% of 2023 overall travel through 9 February 9, compared to 37% for the same period in 2019.

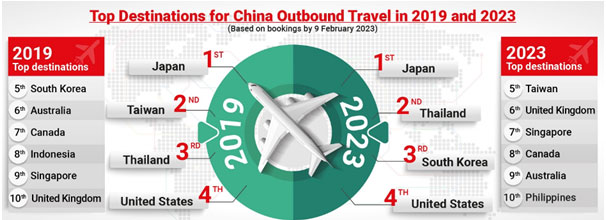

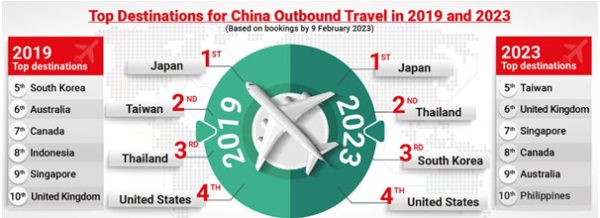

As of 9 February, Japan, Thailand, and Korea became the top three destinations for Chinese outbound travel in 2023, with Korea rising to the third spot from the 5th at the same time in 2019. Bookings for the UK, Thailand and Philippines have bounced back the fastest versus bookings made in the same period in 2019. Indonesia, a top outbound destination in 2019, lost its spot in the top 10 to the Philippines.

Top outbound destinations

It was reported that Indonesia slowed down on promoting their destination to China travellers during the pandemic, possibly impacting Indonesia’s position in the list. Australia’s fall to 9th place may have been impacted by measures implemented on travel inbound from China.

However, while outbound travel is enjoying a strong rebound, restrictions for inbound travel appear to limit inbound travel recovery.

Long-awaited reunions

Sabre’s booking data shows that the largest sources of inbound travel for China in 2023 are Taiwan, the US, Thailand, Korea, the United Kingdom and Canada, with Thailand, the UK, and Canada bouncing back the fastest.

Long-term: New booking habits

Although there is still some way to go before all travel restrictions are lifted for travel to and from China, Sabre data indicates the potential for long-term travel confidence. Booking windows can be a key confidence metric, as travellers are often happier to book further out if they feel confident about their plans.

As of 5 February, 33% of all inbound bookings and 43% of all outbound bookings were made more than two months in advance, showing that there was a likely expectation that travel restrictions may ease further in the next two months and beyond. Only 21% of outbound and 14% of inbound bookings were made for travel within two weeks, versus 37% and 30% in the same period in 2019.

Travellers appear to be planning further ahead compared to 2019, when there were more last-minute bookings. This may be due to new booking habits learned from the Covid-19 pandemic, where travellers have gotten used to pre-planning instead of impromptu trips, or the capacity for China routes has yet to recover pre-pandemic levels, and there are fewer available for last-minute bookings.

Bookings are also slowly recovering to what was evident pre-pandemic, with outbound travel bookings made by 9 February for travel in the first week of April reaching 70% of passenger bookings made by 9 February in 2019.

(Source: Sabre)