SINGAPORE, 2 May 2023: Chinese travellers have started to travel abroad but still prefer destinations within the Asia Pacific, says, ForwardKeys’ China Market Expert, Nan Dai, in the latest Q2 findings about China’s domestic and international travel patterns.

Compiled by ForwardKeys and partner Dragon Trail International, research showed Chinese travellers were keen to try local sights and gastronomy during the Labour Day holiday season, with Macau and Jakarta, Indonesia topping the list.

Labour Day Holiday in China

According to ForwardKey’s freshest air ticket data, bookings for international departures on 28 April reached 79% of 2019’s level, while domestic travel has increased by 233%.

Overall, issued flight bookings for Labour Day domestic travel are 10% ahead of 2019’s travel data. Chengdu and Chongqing, two urban cities located in Southwest China that also serve as the gateway to nature trails have experienced a notable rise in popularity with a 59% and 22% increase, respectively.

Meanwhile, Haikou and Sanya, two popular destinations known for their sun and sea and duty-free shopping, have also seen a surge in demand, with 50% and 26% growth, respectively.

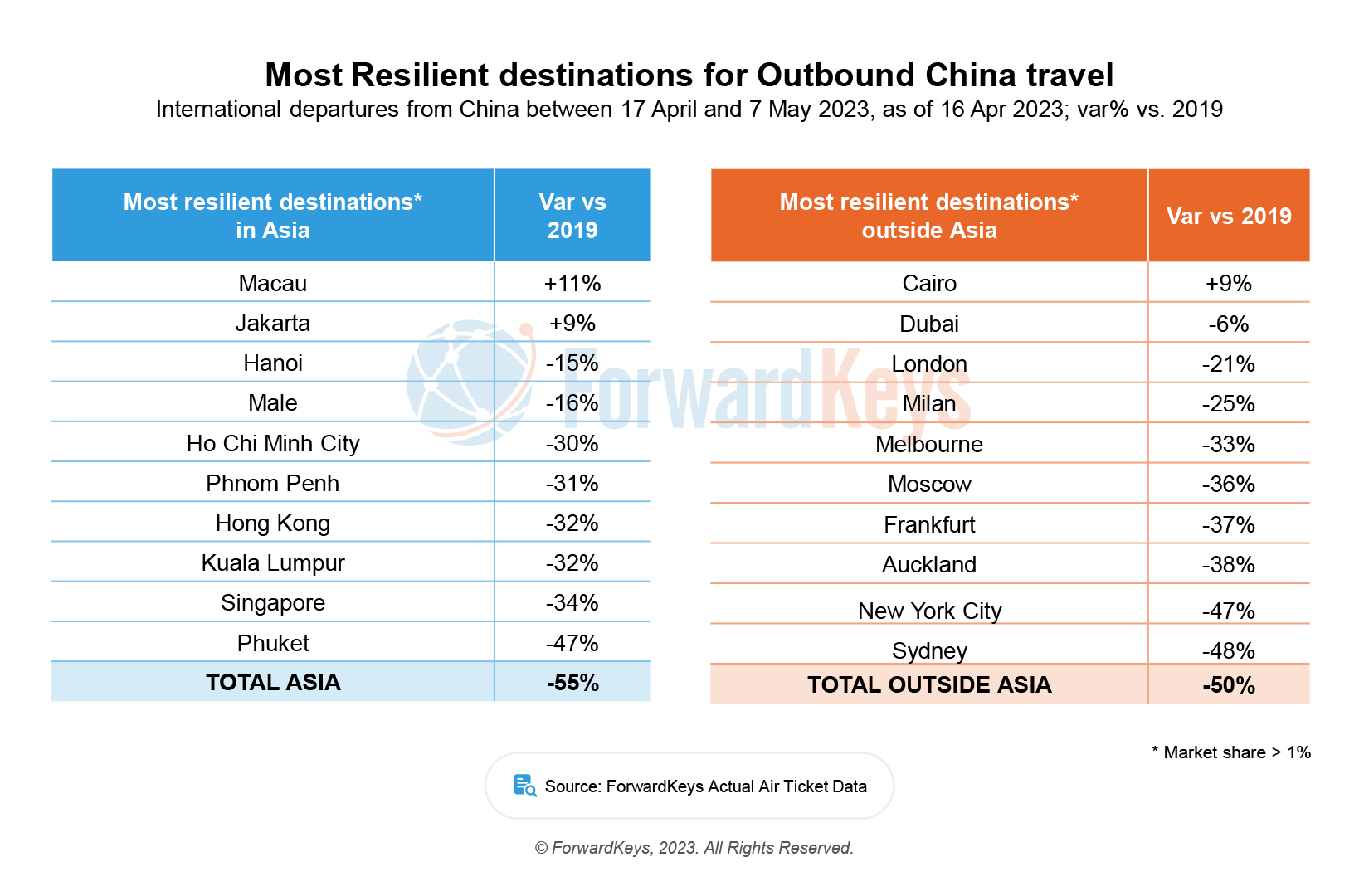

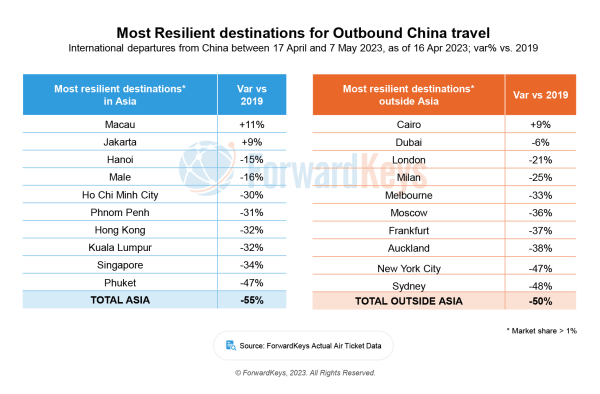

Bookings for outbound travel are around 50% behind the pre-pandemic levels. When examining the most popular outbound destinations that have bounced back, Macau remains a favourite in Asia, leading the list with an 11% increase on 2019 levels. Jakarta, the capital city of Indonesia, which serves as the main gateway to the sun and sea in Bali, is currently 9% ahead of the 2019 Labour Day holiday bookings.

Male (Maldives) secures the fourth spot on the list with an 84% recovery. Phuket, another destination known for its beaches, is also on the top list with a 53% recovery. Sun and sea destinations are having mass appeal now, acting as a major drawcard for Chinese tourists.

Additionally, Chinese travellers can easily apply for a travel permit to Macau and Hong Kong. Other international destinations mentioned on the list are friendly to Chinese travellers, as they provide visa-free or visa-on-arrival options.

Outside Asia, Cairo and Dubai are particularly being more favoured. The United Arab Emirates and Egypt are part of the approved group tour destination list, and both provide visa-on-arrival options for Chinese travellers. Since the visa application process now takes longer than the pre-pandemic period, the visa waiver is a potentially significant change.

Consumer Sentiment Key Indicators

Dragon Trail International undertook a consumer research survey in April, and the survey highlighted a few actionable business decisions if the Chinese outbound market is an important audience for you.

- Travel plans for 2023 are still largely undecided

Only three months into reopening, there is still a high degree of uncertainty and the opportunity for travel brands to influence consumers’ decisions. 26% say they hope to travel outbound but haven’t booked a trip yet, with 27% unsure whether they will travel outbound before the end of 2023. Addressing and appealing to these travellers could bring high rewards for the rest of the year and beyond.

- Safety is the biggest concern holding back Chinese travellers

The biggest factor preventing Chinese travellers from leaving home is safety concern. Unlike limited time or money obstacles, tourism brands can address safety concerns directly. Safety, stability, and friendliness should be core consumer and trade marketing messages to assuage fears about venturing beyond mainland China.

- Food, landmarks, and local experiences are the top reasons to travel

When asked about their purpose for travelling abroad, trying local food and visiting landmarks were the top priorities, with each chosen by 56% of survey respondents. 52% said they wanted to experience local life. Are you making your boutique tours and gastro experience known to the Chinese market?

- Deep dive into accommodation preferences

This edition of Dragon Trail’s survey reveals that boutique hotels (32%), resorts (31%), and home-sharing accommodations such as Airbnb (29%) are all popular choices for outbound Chinese travellers. Both mid- and high-end hotels have appeal, with no major difference between three (26%), four (27%) and five-star (23%) hotels. But you are unlikely to find Chinese outbound travellers opting for anything two stars or below, with only 8% choosing this option.

Q2 China Outbound Outlook

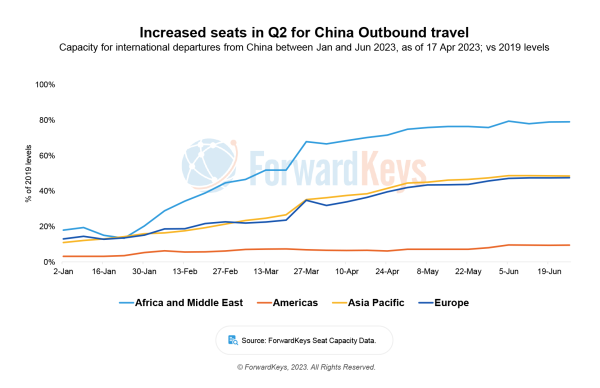

As reported recently by ForwardKeys, the international seat capacity for Q2 stands at 42% of pre-pandemic levels. More destinations are looking to improve their flight connectivity with China.

The APAC region currently has the largest share at 81%, with a recovery rate of 43% in Q2. The Africa and Middle East region is expected to experience the largest growth, with a 75% increase in Q2, although it currently only accounts for 6% of total international capacity from China. The United Arab Emirates is the most well-connected destination in this region, holding a 44% share. At the same time, the number of seats between China and Kenya has doubled since 2019, and seats between China and Egypt have increased by 10% on 2019’s levels.

To learn more about ForwardKeys’ data solutions, visit www.forwardkeys.com