SINGAPORE, 20 December 2023: The International Air Transport Association’s latest projections suggest airlines will declare strengthening profitability in 2023 and its forecast for 2024 signals the start of balance sheet stability.

However, net profitability at the global level is expected to be well below the cost of capital in both years. Very significant regional variations in financial performance remain.

Outlook highlights

The airline industry’s net profits are expected to reach USD25.7 billion in 2024 (2.7% net profit margin). That will be a slight improvement over 2023, which is expected to show a USD23.3 billion net profit (2.6% net profit margin).

In both 2023 and 2024, the return on invested capital will lag the cost of capital by four percentage points, as interest rates around the world have risen in response to the sharp inflationary impulse.

Airline industry operating profits are expected to reach USD49.3 billion in 2024 from USD40.7 billion in 2023.

Total revenues in 2024 are expected to grow 7.6% yearly to a record USD964 billion.

Expense growth is expected to be slightly lower at 6.9% for a total of USD914 billion.

Some 4.7 billion people are expected to travel in 2024, a historic high that exceeds the pre-pandemic level of 4.5 billion recorded in 2019.

“Considering the major losses of recent years, the $25.7 billion net profit expected in 2024 is a tribute to aviation’s resilience. People love to travel, which has helped airlines come roaring back to pre-pandemic levels of connectivity. The recovery speed has been extraordinary, yet it also appears that the pandemic has cost aviation about four years of growth. From 2024, the outlook indicates that we can expect more normal growth patterns for both passenger and cargo,” said IATA’s director general Willie Walsh.

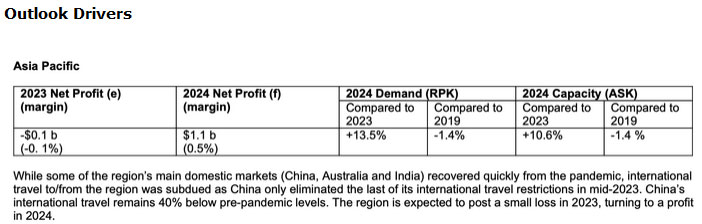

Outlook Drivers

Overall revenues in 2024 are expected to rise faster than expenses (7.6% vs. 6.9%), strengthening profitability. While operating profits are expected to increase by 21.1% (USD40.7 billion in 2023 to USD49.3 billion in 2024), net profit margins increased at less than half the pace (10%), largely due to increased interest rates expected in 2024.

Industry revenues are expected to reach a historic high of USD964 billion in 2024. An inventory of 40.1 million flights is expected to be available in 2024, exceeding the 2019 level of 38.9 million and up from the 36.8 million flights expected in 2023.

Passenger revenues are expected to reach USD717 billion in 2024, up 12% from $642 billion in 2023. Revenue passenger kilometres (RPKs) growth is expected to be 9.8% year-on-year. While that is more than double the pre-pandemic growth trend, 2024 is expected to mark the end of the dramatic year-on-year increases characteristic of the recovery in 2021-2023.

The high travel demand coupled with limited capacity due to persistent supply chain issues continues to create supply and demand conditions supporting yield growth. Passenger yields in 2024 are expected to improve by 1.8% compared to 2023.

Reflecting the tight supply and demand conditions, efficiency levels are high, with the load factor expected to be 82.6% in 2024, slightly better than in 2023 (82%) and the same as in 2019.