SINGAPORE, 19 February 2023: Travel content supplied to corporate and leisure clients combined is set to surpass the annual travel capacity in 2018 and 2019, according to FCM Consulting’s Q4-2023* Quarterly Global Trends Report, citing data from Cirium.

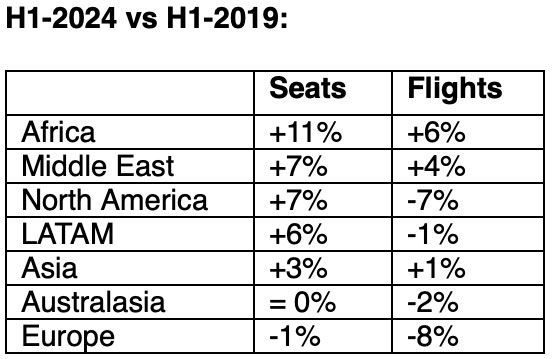

The report also highlighted a key trend set to continue for 2024 — more seats with fewer flights. H1-2024 is forecast to offer more seats +97.9 million (+3.5%) and -2.1 million (-5.6%) fewer flights than H1-2019.

Airline capacity and fares

“This results from fleet configuration changes and schedule shifts to meet the demand. When carefully planned, this will be favourable to airline operating costs, staffing, airport slots and airport costs,” said FCM Travel general manager Southeast Asia Kenji Soh.

“Q4-2023 closed a milestone year, seeing corporate travel the busiest and least interrupted in over four years. Business travellers became more confident than in previous years and are planning trips in 2024 to both grow their business and connect with clients and colleagues,” Soh noted.

“Across the top global corporate airlines, we forecast that the seats offered in 2024 will be two per cent above 2019 and the number of flights offered will be down 6%.”

“American Airlines, Delta Airlines, United Airlines, China Southern Airlines, China Eastern Airlines, LATAM Airlines Group, Qatar Airways, Cathay Pacific, Singapore Airlines, and Virgin Atlantic Airways are all forecast to be back over 100% in terms of seats offered when compared to five years ago.”

Airlines in the home markets of China and India lead Asia’s growth. The top Chinese airlines are forecasted to offer 21% more seats in 2024 than in 2019.

“Singapore to Vancouver saw the highest increase in business class airfares, which increased by 216%. Singapore to Da Lian saw a 212% increase in business class fares as it is a popular destination amongst business travellers for being one of Northeast Asia’s most important financial, shipping and logistics centres. The top five destinations from Singapore were Kuala Lumpur, Bangkok, Jakarta, Shanghai and Hong Kong in Q4-2023,” added Soh.

Accommodation

Regarding accommodation, the average room rates increased across all regions for 2023, compared to 2022, with Asia seeing a rise of USD39, the highest globally.

In Q4-2023, Singapore commanded the highest average room rate paid by corporate travellers per night at USD296, followed by Hanoi at USD$201, Bangkok at USD184, Manila at USD174, Jakarta at USD155, and Kuala Lumpur at USD145.

“Kuala Lumpur witnessed the sharpest increase of 38% in Q4-2023 as compared to Q3-2023, followed by Singapore at 11%. Jakarta was up by just 1%, and Manila remained flat,” concluded Soh.

Despite the increased cost, all regions also saw a lift in occupancy levels year-on-year, with Mainland China – the last major nation to reopen its borders – leaping 34% to have an occupancy rate of 65%. Asia, excluding China, saw an increase of 17%. India saw an increase of 1.8% to 70% in occupancy levels in 2023.

*This FCM Consulting quarterly report draws on global data from FCM Travel and Flight Centre Travel Group corporate booking data for travel from October to December 2023 (Q4-2023).

The report uses Cirium aviation schedule data as of 18 January 2024. Airfare pricing variations exclude all taxes.

The hotel average room rate (ARR) quoted is the average booked rate using FCM Travel and Flight Centre Travel Group corporate booking data. Variations in rates booked reflect seasonality, supply and demand, booking lead times and variations in exchange rates. Unless otherwise stated, all fares and rates are reported in US dollars. STR hotel data and content were quoted as of January 2024 for the period ending December 2023.