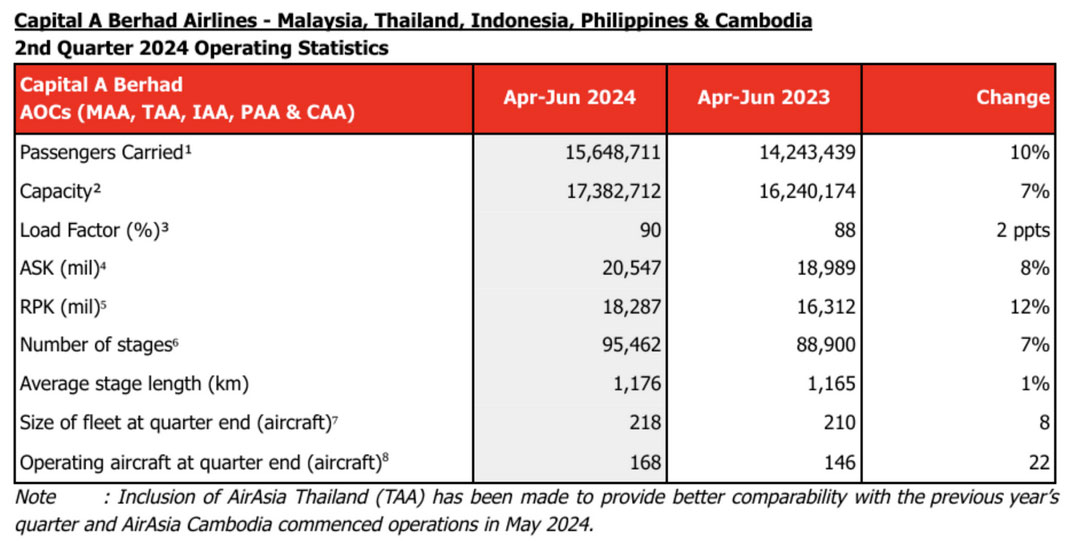

KUALA LUMPUR, 25 July 2024: Capital A has announced operating statistics for its Capital A Aviation Services (CAPAS) for the second quarter of the financial year 2024, indicating the group’s airlines achieved a 90% load factor and flew more than 15.6 million passengers.

Emerging from a seasonal peak in the first quarter, the aviation group – AirAsia Malaysia, AirAsia Thailand, AirAsia Indonesia, AirAsia Philippines, and AirAsia Cambodia — maintained its record-breaking quarterly load factor of 90% in 2Q2024, up by two percentage points year-on-year due to increased capacity.

As of the end of June, the group had reinstated 195 aircraft out of its total fleet of 218 – an additional eight aircraft were reactivated during the quarter. During the 1H2024, the airline reported more than 30 million passengers carried.

Passenger volume continued its upward trajectory, rising by 11% YoY to reach 15.6 million during the 2Q2024. This outpaced capacity growth of 7%, demonstrating resilience in regional travel demand. Routes to China and India were among the strongest, boasting a robust Year-to-Date (“YTD”) load factor of 91%, following visa-free travel implementation at the end of 2023 for China and India travellers. Additionally, both domestic and international segments are experiencing similar growth rates, indicating a holistic recovery across AirAsia’s network. Excluding Cambodia, passenger numbers are nearing pre-pandemic levels, with YTD recovery reaching 84% of pre-Covid figures, surpassing capacity recovery of 81%.

AirAsia MOVE

AirAsia MOVE has transitioned this year from being a super app that offers grocery shopping and food delivery to becoming a travel platform. The focus is to grow flights, hotels, and airport rides as well as build duty-free and activity products. The priority is to grow the app user, as it provides a higher lifetime value. While overall Monthly Active Users (MAUs) are down by 13% YoY, the app’s MAUs have increased by 10% YoY.

Travel: Flight overall transactions are down due to value challenges within the OTA landscape. In response, AirAsia MOVE is enhancing its fare-tracking system and driving targeted promotions to regain competitiveness. Recovery is expected in 3Q2024 and will be back to the 2023 level by 1Q2025. Conversely, Hotels are on a strong trajectory, posting a 33% YoY growth mainly attributed to improved personalisation and inventory.

Ride Hailing: Airport ride bookings are down 10% year over year, but the completion rate has improved by 2% year over year. Moving forward, AirAsia MOVE is focusing more on demand generation and improving the driver app.

AirAsia Rewards and other businesses: Rewards net revenue grew by 45% YoY due to higher point issuance and improved point redemption rates. To grow, AirAsia MOVE focuses on onboarding more external partners to join the rewards programme.