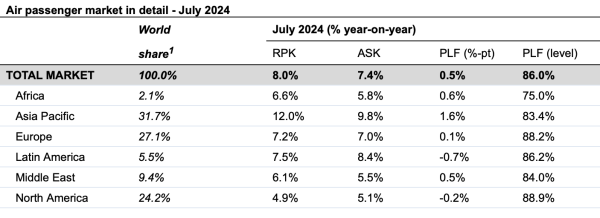

SINGAPORE 2 September 2024: Total demand, measured in revenue passenger kilometres (RPK), was up 8.0% during July 2024 compared to July 2023, International Air Transport Association (IATA) reports in its latest released data this week.

Details of global passenger demand trends confirm a robust recovery. Total capacity, measured in available seat kilometres (ASK), was up 7.4% year on year.

The July load factor was 86.0% (+0.5ppt compared to July 2023). The CrowdStrike IT outage on 19 July had no significant negative demand impact.

International demand rose 10.1% compared to July 2023. Capacity was up 10.5% year-on-year, and the load factor fell to 85.9% (-0.3ppt compared to July 2023).

Domestic demand rose 4.8% compared to July 2023. Capacity was up 2.8% year-on-year, and the load factor was 86.1% (+1.7ppt compared to July 2023).

“July was another positive month. Passenger demand hit an all-time high for the industry and in all regions except Africa, despite significant disruption caused by the CrowdStrike IT outage,” said IATA’s Director General Willie Walsh.

“The winding down of the peak northern summer season is a reminder of how much people depend on flying. As the mix of travellers shift from leisure to business, aviation’s many roles are evident—reuniting families, enabling exploration, and powering commerce. People need and want to fly. And they are doing that in great numbers. Load factors are at the practicable maximum. However, persistent supply chain bottlenecks have made deploying the capacity to meet travel needs more challenging. As much of the world returns from vacation, there is an urgent call for manufacturers and suppliers to resolve their supply chain issues so that air travel remains accessible and affordable to all who rely on it,” said Walsh.

Regional Breakdown – International Passenger Markets

All regions showed strong growth for international passenger markets in July 2024 compared to July 2023, with signs that many markets are returning to long-term growth trends after the post-pandemic bounce back.

Asia-Pacific airlines’ growth remained strong, with a 19.1% year-on-year increase in demand. Capacity increased 20.3% year-on-year, and the load factor was 83.8% (-0.8ppt compared to July 2023). Most Asia routes, with the exception of the Asia-Middle East route, have yet to exceed 2019 levels.

European carriers saw an 8.3% year-on-year increase in demand. Capacity increased 8.1% year-on-year, and the load factor was 87.5% (+0.2ppt compared to July 2023). Regarding major international routes, the Europe-Asia route expanded fastest, reflecting this is still to surpass 2019 levels.

Middle Eastern carriers saw a 5.8% year-on-year increase in demand. Capacity increased 5.5% year-on-year and the load factor was 84.1% (+0.3ppt compared to July 2023).

North American carriers saw a 5.3% year-on-year increase in demand. Capacity increased 6.3% year-on-year, and the load factor was 89.4% (-0.8 ppt compared to July 2023), the highest among regions.

Latin American airlines saw a 13.4% year-on-year increase in demand, and capacity climbed 15.7% year-on-year. The load factor was 87.5% (-1.7ppt compared to July 2023). While hurricane Beryl had a strong localised impact in parts of the Caribbean, the Gulf of Mexico, and the southern United States, this did not significantly dampen demand region-wide.

African airlines saw a 7.4% year-on-year increase in demand, a 6.7% increase in capacity, and a 74.3% load factor (+0.5ppt compared to July 2023).